Often transitions lead to turbulence which becomes a traumatic experience for all involved.

This need not be the case. As a real-life scenario described below reveals, with a concerted effort a consumer goods company was able to figure out the causal factors which impeded the success of a product transition and how they could preempt it in the future.

The scenario and the solution approach have broad applicability in the hi-tech electronics and other product innovation-driven hardware industries as well.

Transitions are of various types – sometimes these are driven by technology-changes, sometimes due to competitor actions, and on other occasions due to product refreshes which may result in phase-out or reduction in volume of older products.

In this note we will cover the transitions that Product enterprises go through when they make major changes to their products or product lines in the context of this case.

Wipeout in Transition – A Consumer Goods Case summary & Key Takeaways

A large consumer brand faced the deadly effects of a product line transition that went totally off the rails. Upwards of $20MM (USD) in losses (inventory obsolescence and write-downs) were recorded.

Management recognized this event, and the fact that this was caused by a single product transition – in other words, a single product event. They wanted to get to the bottom of this fast.

There were hunches and hypotheses, but one of the key decisions made was – let’s have someone from the outside do an operational postmortem of what went wrong and determine what it would take to ensure this didn’t recur in the future. An intensely collaborative exercise with the external partners uncovered two major takeaways –

1) Trust factor depletion – there was a major erosion of trust between Sales and Operations (Procurement & Supply Chain Ops) that took place over a period of time in the recent past before the product transition debacle.

At that time, Product demand was perking up and was being diligently reported by Regional Sales teams, yet Operations apparently got cold feet when responding to the demand – not fully ‘comfortable’ with the ‘optimistic’ numbers from Sales. Shipment volumes were consistently lower than the order volume – resulting in long lead-times, ‘unhappy customers’ and potentially ‘lost sales’. While the part about ‘unhappy customers’ and ‘lost sales’ could not be conclusively established, it was clear that the Sales teams were unhappy with the lack of fleet-footedness on the part of Ops when demand “signals” from Sales were being explicitly communicated to them.

Sales made their displeasure with Ops clear to senior leaders. While such Sales-Ops mismatch on demand is not uncommon, the contentious nature of the recent Sales-Ops interactions and the fact that volumes shipped by Ops was always chasing the growing demand, made the pendulum swing too far to the other side when the next change hit, namely this product transition with several technology changes in the new product.

Takeaway: when the ‘trust gap’ between Sales & Ops grows noisy, it’s time for leadership to pay attention and act on the data-points.

2) A Transition Planning process and owner and a tool – Except for quarterly business reviews, Ops glitches – such as a missed delivery, or growing lead-times – rarely get top leadership’s attention, unless it directly impacts a large customer/channel partner or revenue. As such these operations ‘micro-events’ are stashed away in corporate (tribal) memory as one-offs with lessons learnt based on isolated reviews. This works for most garden-variety operational issues, most of the time. Not so for transitions.

Transitions are a critical time and a critical driver of future revenue from new products.

In the frenetic activity to launch a new product with new technology-set, a big process component was missed – How to plan the transition? What’s the ideal way to transition? What if things went off the ‘desired’ course – push-out of launch dates, lower shipments in channel than Sales plans? How to navigate the transition in such cases? Even experienced Ops teams often miss this. A conscious effort has to be made to chart out the transition process and more importantly all the moving parts involved –

- What is the Product’s Transition Plan? When & how to change it?

- Who is responsible for transition planning?

- Whose inputs are needed when making changes?

- How do changes affect decisions and plan? How to communicate decisions and plan changes?

Key Takeaways: First and foremost a Transition Planning process needs to be defined working across functions.

Next, the ownership of the Transition planning process needs to be clearly defined, including the cross-functional team members.

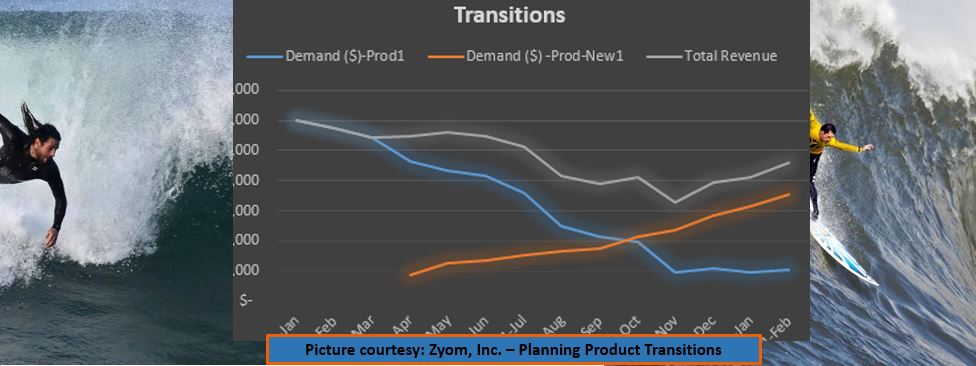

Finally, there is a need for a tool – a digital transition planning tool which companies can use to generate transition plans fast, plan & decide among different ‘What-if’ scenarios, re-plan in real-time if needed and distribute the resulting actions across all team members quickly so follow-up execution can be completed before it’s too late. A metaphorical surfboard to ride out the transitions.

Think about it. In day to day Operations, most of the planning resources and energies are deployed on products in various stages of volume production. However, for critical product transitions which can be a make or break for smaller companies, we think the same (Volume Production Planning) approach will do.

No it will not.

Product transitions have their own patterns and noise – as this company found out too late..

With careful thought, planning and attention of the right cross-functional team guided by Operations, companies can smoothly ride out a transition “wave” and catch the next one to go higher.

(Thanks to Alpana Sharma and John Duvenage for edits and organization)