In the current backdrop of an ongoing pandemic, persistent inflation, the corrective actions being taken by central banks, its confounding impact and a widespread feeling of uncertainty, Profitability has taken center-stage again when evaluating the near and longer-term operational performance of Product companies.

This article highlights some of our experiences and learnings to answer the questions –

What are the different pathways to profitability, or growing profits (for companies that have achieved profitability)?

What to watch out for?

These learnings are for Operations teams, their leadership and all leading or supporting cross-functional operations (Finance, IT, Engineering).

Putting Profitability on the back-burner will burn your enterprise

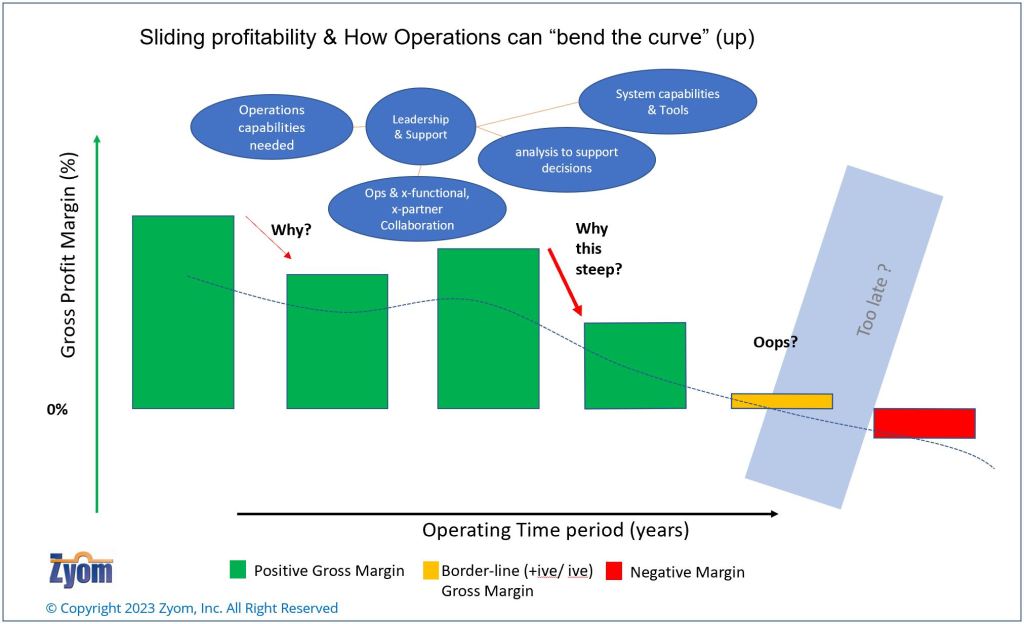

Companies that pursue ‘growth only’ approach, without careful attention to “profitable growth”, risk losing sight of the insidious effects of factors that will erode eventual economic value of the enterprise. How? Growth, especially growth at a breakneck speed* invariably leads to poor quality of attention being paid to anomalies in ‘cost of growth’. Growing costs creep in even when a company grows in line with plans. With unplanned growth, growing costs become bad news that arrives too late, eventually derailing the path to profitability for larger and mid-size product companies alike.

A Company that loses their ‘path to profitability’ (including sustaining their profits), loses the chance to maximize its own value and provide maximum value to customers. Key questions for company leaders –

- As you make Plans, especially those with longer-range impact (e.g., adding factory or warehouse capacity), do you have a clear picture of its impact – on existing customers, on profitability?

- What if (.. list any of the many changes here) happens?

* Seen in the pandemic times circa 2020-early 2022 in a subset of IT goods and e-commerce industry

Manufacturing & Supply Chain Operations teams are core to any product company’s mid to long-term survival and profitability; their evolving mandate

Over the last 2+ decades, this author has observed the slow, almost inexorable slide downwards, of the role of “Manufacturing and Supply Chain Operations” teams in companies that design, make and ship branded products – across many industries (from Hi-tech electronics to consumer appliances, to name a few).

As ‘outsourced manufacturing’ in several industries, stripped away the ‘physical assets’ (machines, tools, materials) that Operations teams were responsible for, operations teams shrank – often, with good reason. Unfortunately, the Operations function’s importance as a strategic partner of the CEO, as a part of the executive team, shrunk too, overwhelmingly – except, in those organizations where the Operations leaders were strong change influencers and facilitators, and the CEOs and other influential leaders were clear about it. Clear about the fact that – Operations team and their leaders are core to the company’s success – whether manufacturing is outsourced or not.

This phenomenon was upended by the global pandemic starting circa early 2020, as factories, materials needed, ports, and people working these, froze up, and buckled under their weight of the pandemic.

Only those companies can serve growing markets profitably in the longer term, when key leaders and the CEO are clear that Operations team and their leaders are core to the company’s success – whether manufacturing is outsourced or not, and the Operations mandate will need to evolve

It appears that this, among other reasons, have resulted in a shift, which is yet a ‘work in progress’. Indeed, Operations teams are now playing key roles at companies, at least among stronger ones, often in new, strategic settings – in some cases, the Operations leaders getting invited to share their “supply chain insights” in quarterly, financial, market-facing calls, alongside the CEO and CFO.

This is the right time for Senior leadership at Product companies to work closely with their Operations leadership team and build out the necessary competencies and capabilities needed, so they are not caught flat-footed, and new ways of operating are developed and implemented, as the pandemic persists, and other major “supply constraining” events take place (war, weather-related/ climate-change induced disasters, and their aftermath, etc.), some of which may seem deceptively “further out”. Key question –

- What key Operations capabilities and competencies are needed now?

- How will the Operations function evolve – Can Ops step outside of the ‘cost control’ function (traditionally, a “comfort zone”), and contribute directly towards the ‘profitability’ function?

How can Operations step outside of the ‘cost control’ function (traditionally, a “comfort zone”), and contribute directly towards the ‘profitability’ function?

We have seen transformative results when Operations leaders have such a mandate. However, a ‘mind-shift’ is needed.

For example, during a time when one of the largest integrated Steel plants in India, Tata Steel, was facing severe input constraints, our founding advisor’s work to optimize operations directly helped expand profit contribution even as total output volume went down, resulting in a radical rethink of how to manage operations (International award-winning work by Dr. Gopal P. Sinha**).

A word of caution here – Do not go back to the old ways – i.e., diminished attention to the Operations function when these “economic clouds” start clearing up and “headwinds” to Revenue growth diminish.

** Franz Edelman Award for Achievement in Advanced Analytics, Operations Research, and Management Science

https://www.informs.org/Recognizing-Excellence/INFORMS-Prizes/Franz-Edelman-Award/Franz-Edelman-Laureates2/Franz-Edelman-Laureates-Class-of-1994

Deliberate & Intelligent Collaboration is the only way for any company to succeed

While this is true for enterprises of any size, irrespective of their relative position in their industry, it is especially true for younger (growing startups and scale-ups) and mid-size companies that have to innovate and grow their products and offerings. “Collaboration” with a capital “C” can result in many intuitive and non-intuitive benefits. Highlighted below is one –

Unexpected “value” and “insights” from suppliers and their products, especially those with a “collaborative” approach. Credible smaller providers (i.e., with proven success), may have a lot more to offer than larger providers, since “innovate and execute” is core to their survival and growth.

For example, in one case, a Procurement executive at a growing, mid-size product enterprise was “surprised” how a system (provided by Zyom) significantly improved collaboration with Finance, reducing time in hand-offs between Ops and Finance, and eliminating errors which resulted in higher supply costs, in addition to other primary benefits. Question –

- Have you explored any credible, new ideas in managing cost, and improving profitability with all your suppliers?

Supply driven “Inflation” needs a different mindset & tools

As the US, Europe, Japan and most free-market economies grapple with the most severe inflation in the last 4+ decades, it is an imperative to approach this ‘inflation’ cycle with a different mindset, in terms of operational execution.

In this case, persistent inflation was triggered largely by a once in a 100-year pandemic resulting in massive, cascading disruptions to global supply chains, choking supply severely (demand largely intact after the initial shock), the resulting policies (government, central banks, even companies – inducing more demand), subsequent uneven return to normalcy (China, an important global player, has entered a dangerous phase 2 of the pandemic, as of December 2022). Geopolitical unease between the US and China, the attack on Ukraine by Russia, has forced speedy rethinking of supply sources, making matters very difficult for those operating global supply chains.

The Chief of Operations always had a dual mandate – Right amount of flexibility at an optimal cost, which are at odds with each other.

Flexibility implies flexibility in the manufacturing and supply network – capacity, inventory, etc.

Costs include all product and operational costs that impact cost of goods sold.

Increased flexibility directly leads to higher costs, often a step-function increase.

In light of the evolving global pandemic and ongoing supply constraints (though, getting better), key questions for Operations leaders and the CFO are –

- What specific decisions can Operations directly support to address the profitability squeeze (due to inflation)? How? (Latter will require new tools)

- What key new metrics are needed? What traditional metric/s needs to be revisited?

What specific decisions can Operations directly support to address the profitability squeeze (due to inflation)? How?

Stop looking for (system enabled) answers in the wrong places

To navigate successfully, in this new, rapidly changing environment requires a Rethink – especially regarding process,data and analysis support needed by cross-functional Operations teams. Do not expect a zero-risk mindset to work if you are trying bring on-board any new capabilities that your enterprise currently needs, or may not know that it needs. The right partner can help uncover these ‘unknown needs’. And casting off this zero-risk mindset is a prerequisite to drive profitable operations.

Too many companies scale operations to reach a certain ‘threshold’ volume, only to decide, without adequate due-diligence, that their growth is being constrained because their existing ERP system cannot “scale up”, and that they need ‘add on’ ERP capabilities from the incumbent, or (worse) start implementing a new ERP system.

This is a classic “integrated-solution out of the box” logical fallacy which is played upon by entrenched incumbent providers (especially ERP software provider and their cohorts). Why is this a fallacy?

This is a classic “integrated-solution out of the box” logical fallacy which is played upon by entrenched incumbent providers (especially ERP software provider and their cohorts).

Most ERP[1] systems have been laggards, even to date (2021 – 2022), in vital areas such as “Planning”, especially context-rich planning, which, ironically, is what the ‘P’ in ERP is supposed to stand for.

Some ERP suppliers have plugged their holes partly with acquisitions. Despite this, they struggle and make their customers struggle, under the unending burden of their long, expensive implementation cycles, often, even for basic ERP (Accounting/ General Ledger, Inventory) capabilities.

Unfortunately, since risk-aversion in adopting and implementing systems runs high among decision influencers, the malaise persists. “No-one got fired for buying XYZ” being the prevalent mindset (replace XYZ with any of the afore-referenced providers) – a system largely built to be a repository of transactional data, is stretched and patched to “add on” other capabilities – in the name of “integrated solution”, only to fall woefully short.

Looked at another way- a largely “commodity” software with “General Ledger/ Accounting” as its core, has been stretched and bloated to be utilized for highly specialized and often strategic needs, without having qualifying capabilities or people to support the extensions (at the ERP provider). This is damaging in the short and the long run for the product enterprises deploying these, given the predictable longevity of these implementations.

The questions to ask internally is –

- Can we wait 2-3 years to get these critical operations management capabilities***? And incur the costs (of waiting)?

- Do we understand our “systems” decision blind spots and biases?

- Are we even looking at the right type of system solution or provider partner?

*** 2-3 years based on actual data from Zyom. less than 50% probability of expected outcome in areas of planning, context-specific analytics, operations execution

On Leadership, in brief

With a seasoned Operations leader at the helm, who has seen a few operating seasons, and knows about “why” and “what” of specialized Operations Management systems, these de-risking debacles (“let’s do it all in our ERP system modules”) are pre-empted – i.e., cognitive biases and fallacies mentioned before, avoided or overcome. However, the very companies that need such leaders – growing mid-size companies or younger, faster paced scale-ups – do not have access to such leaders in a timely manner.

The question for the CEO and senior leadership team is:

- Do we have a seasoned Operations leader who not only understands the business needs (what’s needed in the supply chain, team) but also recognizes the unique data and system enablement needs of operations? If not – identify a suitable partner (internally, and externally).

- Do they know (or have adequate support to identify) what types of software systems outside of ERP are available and effective to support Operations teams?

Implementation is It.

Perhaps this is the most important learning of all.

In fact, this is where most worthy operational change goals can bite the dust, especially if “lets extend the (heck out of out) ERP system” mindset persists, when considering system enablers. This is where specialized providers (such as Zyom) create a better world for Product companies and its system users, by being laser focused on Implementation, no matter what. This is the only way meaningful changes are implemented and benefits realized.

Once the initial “visioning” has happened, the hard and soft requirements have to be “implemented”, whether in changes to processes, or to software systems enabling the process change. This is where many, if not most, ambitious digital enablement efforts fall way short. Digital transformation remains a distant pipe dream.

A sizeable volume of words won’t be enough to cover key learnings about such system implementations and how it is effectively integrated into processes (potentially, a future post). Needless to say, to attain/sustain/grow profitability, a new way is required – new collaborations and potentially new systems and tools.

.. to attain/sustain/grow profitability, a new way is required – new collaborations and potentially new systems and tools

Because, this is where the rubber hits the road, and things can go flat and flounder, or zoom forward, even soar.

With a new 2023 starting, this is the right time to sketch out such a change, talk to such a partner.

Reach out. Start a conversation.

[1] ERP (Enterprise Resource Planning) providers – SAP, Oracle, other larger ones (trademarks, etc. owned by the respective companies)