In the Finance function “inventory,” as a default, is reported as a “Current Asset.” Ask those in Supply Operations. They’ll tell you that nothing could be farther from the truth. This is especially true in times when demand uncertainty[1] grows.

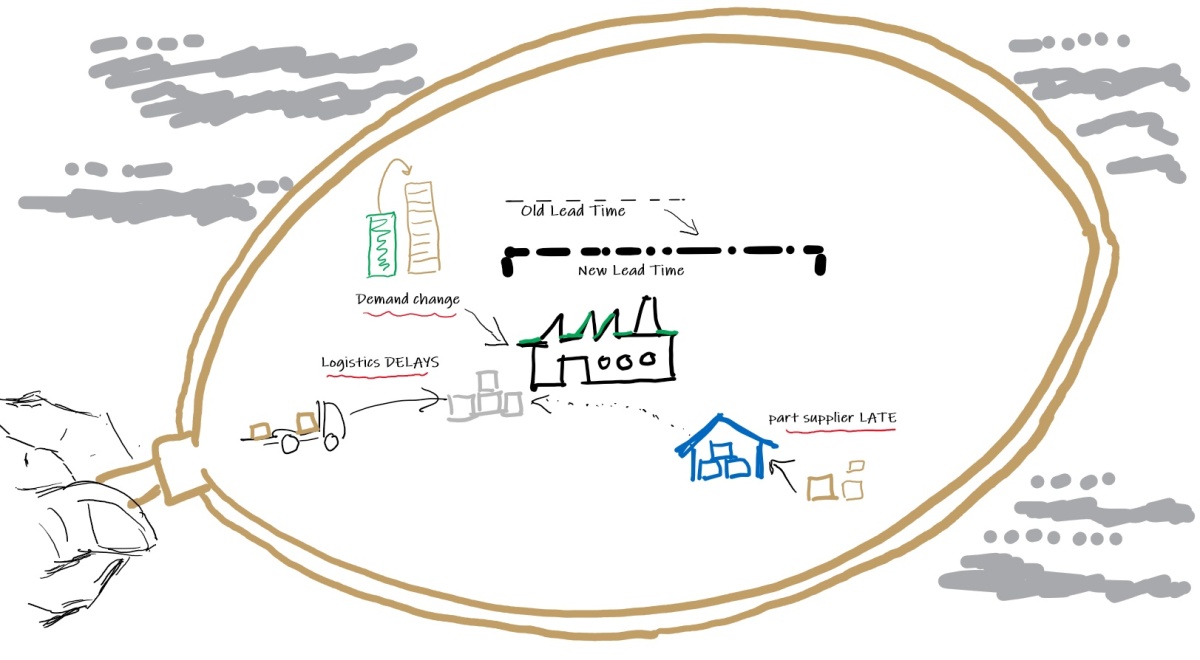

Managing inventory in companies that manufacture and ship products is a demanding exercise. It requires careful consideration of all the variables that impact demand and supply at various nodes of the value network (not just the supply network). Decisions have to be calibrated using data and inputs across functions – decisions, often based on approximations and imperfect information. And it must be done on an ongoing basis, otherwise important data or signals can slip through the cracks.

It becomes even more complex in cases where companies sell through channel partners (distributors, VARs[2], etc.).

Channel inventory, specifically Distributor inventory, is deceptive. Although, it is no longer on your company’s books, you are not off the hook for it either. Among many things, it depends on the skills of the channel partner in managing inventory and reordering, your contractual relationships, and other factors – such as inventory and ordering patterns across your value network.

If demand changes significantly, then orders for your products can swing up or down. Inventory sitting at your channel partners can also be returned in some cases (“stock rotation” for instance). This can lead to unforeseen reduction in your Revenue. Costs will also increase as you restock your channels with newer products and take receipt of older stock. In times of heightened and persistent demand uncertainty, it does not take too long before inventory is no longer an asset, but more a noose around a company’s neck.

In times of heightened and persistent demand uncertainty, it does not take too long before inventory is no longer an asset, but more a noose around a company’s neck

[1] measured by the rate of change of demand variability and demand volatility; *H1, 2025 has been a period of heightened uncertainty driven by the many sizeable tariffs directed by the US against global trading partners, “reciprocal tariffs” being the latest shell to drop in a scarred global trade-war landscape ; the impact of this on demand uncertainty (variability), already evident in many industry segments (based on direct and secondary data) is yet unfolding.

[2] VAR = Value Added Reseller

The dual-mandate of inventory, structural implications

This results in the “dual mandate” faced by the COO and team, balancing two important but opposing needs –

– Carry enough inventory, including buffers, so you fulfill customer orders as needed, as they arrive

And

– Keep Inventory levels low so you do not have too much capital (money) tied up in stock, to run your operations

Compare two companies (illustrative example) –

For example, Company “A” that is carrying $500 Million in average inventory to fulfill $1 Billion of Revenue in a quarter,

versus

Company “B” that’s carrying $300 Million in inventory to fulfill the same level of Revenue – i.e., $1 Billion in a quarter

Company B has a significant structural advantage over company A.

So, inventory reduction is not an arcane, tactical task only to be initiated due to a near-term blip. Go ask your Supply Operations leader[1] to drive down inventory by x% (40%, as in the example above). And everything will be fine.

It is a critical initiative to drive down the capital requirements that gives your company a structural capital advantage. This requires careful attention to details while keeping an eagle-eye on the goal.

If you get this right, you can go much faster up the revenue and growth curve, having more freed up capital via healthy margins to allocate to smart growth (Revenue generating) initiatives.

Get it wrong, and you will not even know something is amiss for a long time. Then things can turn ugly quickly.

Get it (Inventory initiative) wrong, and you will not even know something is amiss for a long time, and then things can turn ugly quickly.

But inventory reduction, especially in channel centered selling models, is even more complex and difficult, as our experience and research shows. This is true whether you manufacture in-house or utilize outsourced manufacturing.

Status quo is often the biggest enemy.

David Cote (ex- CEO of Honeywell) articulates this well with a short story of his experiences as CFO at GE’s major appliance business, in his book – Winning Now, Winning Later (see “References” section at the end).

David’s story provides broad brush strokes on the key leadership mandate and insights gained. As a part of Zyom, we have worked closely with our customers’ cross-functional Operations team and their leadership in the trenches. We have been focused on achieving similar results in operations process optimization for our customers’ operations at physical product companies.

A key part of our customers’ successes has been our ability to collectively dive into the demanding details.

And, in almost all cases, we have come away with surprising findings as we have rolled out our end-to-end planning and execution framework and Operations Management Support (OMS) software system across product companies. Companies that were at different phases of their growth and development cycle.

We do not have inventory reduction numbers that we can share here. What is clear is that by slashing the end-to-end planning cycles by over 80%[2], we helped them achieve significant capital efficiencies – something they had not experienced before. How?

Very briefly – by achieving increased process velocity, across a focused set of end-to-end processes.

by slashing the end-to-end planning cycles by over 80%, we helped our customers achieve significant capital efficiencies – something … not experienced before. How?

.. by achieving increased process velocity, across a focused set of end-to-end processes

The sustained[3] structural cost advantages that customers gained has freed up scarce capital which can now be allocated to other critical initiatives. This gives them an unprecedented operating advantage.

[1] working with Channel Sales depending on where inventory is high

[2] Based on analysis conducted and vetted by our customers

[3] Cost advantages achieved are structural (lower inventory levels to ship out the same revenue), hence recurring

Inventory levels rising ? Watch out!

Inventory (specifically, Channel inventory) is a double-edged sword. On the one hand, maintaining near-optimal channel inventory levels provides a competitive edge by ensuring fast and cost-effective order fulfillment. On the other hand, if inventory levels creep up too high, it can quickly become a noose around your neck – a heavy financial burden.

Left unchecked, rising inventory can impair your company’s financial performance in the near to middle term. This due to carrying much higher inventory levels for the amount of revenue shipped.

In case revenue growth shifts or slows down, you will be left holding the bag on ship-loads of inventory (much of which must be written down or written off).

Longer term, this will push your company into a corner, impairing your competitive standing.

As a Chief Operations Officer, you must ensure your inventory optimization initiative always bubble up to the very top. Make this a strategic initiative. Ensure ongoing support from the senior leadership. Mobilize all team members. Ensure it’s not just a tactical one-off.

See the ‘Actions’ block below. Drop us a line. We can share a picture and real-life stories around that. This can help your cross-functional team visualize how our customers and other senior operations leaders have successfully tackled this challenge, steering clear of those insidious inventory icebergs.

Actions for the COO:

- How is inventory connected with process cycle time?

- How will increasing process velocity help us lower the overall levels of inventory (finished goods, raw-materials and semi-finished stock, work-in-process)?

- How should we go about increasing process velocity (which end-to-end processes)?

- Have we received any “outsider in” perspectives on how you are making decisions in your value network (not just your supply network) and its impact on inventory? how is it leading sub-optimal inventory?

To learn more contact us here, or below. Stay tuned. As always your comments are a gift to all.

References:

1) (Book) Winning Now, Winning Later: How Companies Can Succeed in the Short Term While Investing for the Long Term Author – David M. Cote

Disclaimer: Generative AI (GenAI) was used in a limited way for improving clarity of sentences only for this article. GenAI was not used for composing any of the writeups on this site (including this one), nor for any data gathering. GenAI was used to generate both the pictures in this article. At this point of time, there is no plan to use Generative AI to generate new content on this site. Readers will be informed in advance if this changes.