A note for COOs and team on Inventory & Inflation

(updated Feb 10th, 2025 with tariff changes & rollout updates; previous update Feb 2nd, 2025 with post-tariff imposition data & ADDENDUM at bottom; previous update: Jan 31st, 2025 5:10 pm US PST)

To start off the year 2025, we decided to read the tea leaves a different way – we went looking for clues on what will it look like this year that we should plan and prepare for? what needs to be brought into sharper focus – priorities revisited, big perils identified, collaborations renewed?

This note, for those that are in the physical goods industries – is about what should be top-most priority over the next 30 to 90 days that COO & team should focus and act on. And the focus should not diminish as the year wears on, and beyond.

The Gathering Dust Clouds

The year 2025 – is off to a strange start – a new administration in Washington that, on the surface, appears inclined towards policies which at a meta level, will fragment the world further – at least from a global supply network standpoint. This could potentially realign previously implicit “friendly nation” status, and most likely impact the free flow of goods adversely, increasing procurement costs in the US and inevitably beyond. This, given the tariffs directed at goods from Mexico and Canada among other countries, high on the incoming administration’s wish list (now a reality as of Feb 1st, 2025)

“Wall” of Tariffs, a bigger wall of uncertainty

A wall of worry has unsurprisingly descended on the most senior leaders of product companies with a global footprint, especially COOs and their cross-functional teams managing world-wide operations of US based companies that procure parts and finished manufactured goods from the countries targeted.

While speculations that new US administration’s tariff “statements” were a pre-emptive move to gain a strategic negotiation advantage have been negated by President Trump’s announcement yesterday (Feb 1, 2025), there is nervous optimism that the worst may still not come to pass (i.e., maybe a near-term, a quarter or two out type setback), or so some industry groups hope.

[Update – Feb 10, 2025: Tariff implementation continue to be dynamic –

- those directed at Mexico and Canada have been put on hold for a 30-day period

- 10% import tariff directed at China is now in force with some “go and stop” around the “de minimis trade exemption“

- New tariffs of 25% are in the works for Steel & Aluminum imports imports to the US, and potentially Euro zone trading partners ]

Understandably, anxiety levels are now running high – especially among senior Operations executives who source goods (semi-finished, or finished products) from Mexico and Canada, given the direct, damaging pressure it will put on COGS[1] of even well-run, US based product companies.

That the air in global trade circles is thick with anxiety over the impact of the disruptive changes, is a given. What is less understood is the impact of the inflationary headwinds, the inevitable tit-for-tat type tariff wars and low-trust trade environment will have on midsize companies, and even larger ones that do not have large cash buffers to tide them through.

The picture that emerges – of the damage this does to the balance sheet of (previously) “friendly” nations, many of who are already saddled with debt, does not look pretty. For potential impact numbers see “ADDENUM” below.

This is happening at a time when many industry supply chains could be carrying high levels of potentially excessive “inventory” with a foggy, near-term demand picture. All in all, January-February of 2025 (potentially H1, 2025) is a fraught time, uncertainties abound, especially about global trade and supply networks.

[1] Cost of Good Sold (COGS)

How to cut through it?

What’s an operations leader to do in such a time? Focus. Focus on these two items not just for now but all year long and beyond.

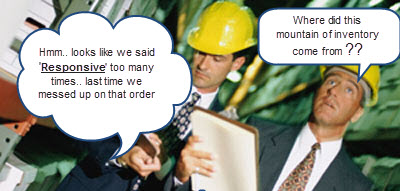

Focus-1: Inventory

Keep a “Hawk eye” on inventory. Inventory, no matter where it is in your value network – at suppliers, in your DC/WH[1], or at your channel partners, or some mix of these.

Inventory of parts/ raw-materials, semifinished and finished goods.

Pay particularly close attention to components/parts that suppliers may be holding for you, or may have been ordered from component suppliers – Tier 2 or Tier 1, based on the extent of outsourced manufacturing you have deployed.

Keep a sharp focus on how inventories are trending at your channel partners (distributors, VAD[2]s etc.) in the case of channel centric sales model, and/or your largest direct customers, and prepare to take informed actions swiftly to right size channel inventory levels ASAP, when needed.

Keep a sharp focus on how inventories are trending at your channel partners.. your largest direct customers .. prepare to take informed actions swiftly to right size channel inventory levels ASAP

In fact, look at every nook and cranny where high value inventory may be collecting and gathering dust.

Then step back, make informed decisions based on upcoming demand, which in this environment could be much harder to pin down.

Excess inventory can severely disrupt product and technology transitions too – for example, holding back product companies from transitioning products to new hardware/software platform, to key parts, or to an entirely new industry standard. Often, such a transition comes with advantages for the product maker (lower unit costs, better performance, etc.) and their customers (lower price points for similar or better capabilities). With excessive inventory, a product company gets stuck on older versions of their products – unable to obtain the advantages of achieving a lower price point for similar or better output performance for a much longer time, or ever.

A quick point – That end of quarter demand “hockey – stick” needs to be looked at with a new lens too. Today’s hot order, which will put us well over the top end of our quarter target(s), could be a noose around our necks in a quarter or two, or soon thereafter. Change sales incentives if need be. Unusual times call for businesses to not operate “as usual”.

[1] Distribution Centers (DC) / Warehouses (WH)

[2] Value Added Distributors (VAD)

Focus-2: Inflation (tariffs etc.)

Mind the “inflation gap” – the gap between “newly normalized inflation rates” (macro, estimate of inflation based on ‘aggregated’ data), and what is actually happening (actual inflation rates faced by manufacturers/suppliers in the supply chain).

Yes, Chair Powell and Federal Reserve team have done a heck of a job when it comes to taming the inflation beast, but with uncertain times ahead – unpleasant realities (unanticipated sudden spike*, stubborn or higher inflation, etc.) can come to pass rather quickly.

* In light of the announced Trump Tariffs a sudden spike in inflation is all but guaranteed on some key goods imported from nearshore manufacturing partners Mexico and Canada – food, fuel, autos and electronics to name a few.

As the US and other prime-mover, free market economies, enter an uncertain phase of the business cycle (have we landed yet ? hard or soft landing, or some mix of those?), and the predictable purchasing price inflation caused by tariffs imposed on inbound goods into the US, the job of Supply operations team – planners, procurement and manufacturing – has to be redefined and skills upgraded quickly.

Monitoring impact of inflation on piece parts’ and other key input prices (labor, etc.) will not be a one off that many experienced during the pandemic, but will become a regular feature of their role. And the smartest, forward-thinking operations leaders already get it, and working on capabilities to enhance their team’s performance.

Monitoring impact of inflation on piece parts’ and other key input prices (labor, etc.) will not be a one off that many experienced during the pandemic, but will become a regular feature of their (Supply Operations – Planner, Procurement) role.

They are building better processes enabled by new digital capabilities so procurement/materials management teams are “always on” when it comes to sniffing out an imminent threat of inflation so it can be snuffed out.

Most Operations teams (Procurement, Manufacturing), already went through a bruising time as the shock of the initial lockdowns of the pandemic gave away to the shocking increase in lead times and unit cost of inputs.

This time around it could get a lot tougher. Because, we don’t yet know if we are sliding towards a slowdown or recession – mild, medium or severe – this year (next 2 to 3 quarters are key), or, are we racing down.

For when the chips are (really) down across all product companies, i.e., the downward part of the business cycle, and trading partners are not seeing eye to eye, and inflation rears its head in ugly way – there may be no place to hide.

Your COGS will get a bruising.

Your margins may get neutralized, and you may bleed into the red.

Key Questions & Question the Status Quo

These are the two things for COO and their teams to focus on this year and harness all their collective energies to stay ahead of any potential disruptions. Some key questions to prepare better:

a) What will be the impact of inventory (starting with inventory downstream in the channels/ at customers, working backwards to parts level inventory) if product uptake deviates from plan, or other changes/ events happen which dampen demand or modify it significantly? What key decisions need to be taken? When and how to minimize any adverse impact?

b) How to monitor inflation and its impact on product cost? What specific approach and actions (smart negotiation, smart sourcing among others) can companies deploy to get ahead of the curve on tariffsthat will lead toinflation in procurement costs? What tools will be needed support such actions to mute or mitigate the impact of higher prices? What’s the the best way to measure the impact on product costs (bottom-up, top-down, other) and evaluate options?

As Supply Operations and Demand-gen operations team rush from one quarter to the next, what should the cross-functional teams plan and be prepared for, so they can harness experience, data, insights and tools, including enterprise software, as needed, to:

- Plan and prepare for different scenarios (cost changes/ increases, sourcing changes, changes to supply chains, etc.)

- Get alerted on deviations in Inventory & Inflation (tariff driven or otherwise)

- Make data-informed decisions (clean data available via collaboration is key)

- Ensure that learnings from deviations can be captured for the future

Question any responses that sound like “business as usual”.

What can we do?

Reach out and build new partnerships – not just with new physical goods suppliers but with digital (and expertise based) goods suppliers.

Companies (at least in the US) need to start looking inwards within the US, to find reliable, quality manufacturing and other supply sources here – including upstream component & commodity suppliers, assuming their cost structure and business model supports it.

Near term

Start working on establishing relationships with US based manufacturers sooner than you previously thought.

In the near term (current Quarter to 3-4 quarters out), higher quality, cost-competitive US based manufacturers may see their capacity getting quickly gobbled up, as product companies turn inwards. Better to “reserve capacity” now, before you are “shut out”, or are put on a “waiting list”.

New factory capacity and capability takes a long time to come online, be vetted and ready.

And, of course, negotiate with your suppliers in the tariff impacted countries – Mexico and Canada, for now. Its surprising how adversity can create more open channels of collaboration provided these are the right partners.

Longer term

Longer term (2-4 years and beyond) – the jury is still out. However, some of these tariffs may gain wider (not just “populist“) support across policy makers and end customers, and may become sticky in some industries – especially, if it lifts up nation-specific manufacturing capabilities (in this case, lifts up American manufacturing broadly).

So, this may also be the time for longer term plans which may include:

a) vertical integration via acquisition (acquiring the right manufacturers, critical upstream supplier), and/or

b) putting down concrete near-term plans to invest in your own factories here in the US (or wherever the company’s home-base is), with the goal of pouring concrete soon, or acquiring a factory or more, if needed

c) Hone your manufacturing supplier relationship management skills which has been blunted over the past 2+ decades of outsourcing in many industries. No, not the classic sourcing (RFQ based identification of competent suppliers, etc.), but getting waist deep in the trenches with your manufacturing partners – sharing know-how and collaborating deeply on your product specific manufacturing, materials management, collaborative planning, supply chain and even factory operations management. Yes, some skills have been dulled or lost over time. Yet this short-term pain may serve many product companies well – if its used to sharpen these skills again.

These are big changes with potential for big disruptive operational impacts on product companies near-term. However, longer term their effects could be virtuous, if your product company starts planning and preparing now.

To learn more on how we, and our advisors, have specifically helped support our customers, feel free to reach out.

We can share a few specifics, real-life stories, ideas and more of what we have learned working with senior leadership, and their cross functional operations teams across this business cycle and before, across two Fortune 100 companies and smaller, dynamic product enterprises.

To reach out https://zyom.com/contact.php

Or, leave a comment here That will be music for our ears, and we will respond.

ADDENDUM

New details are emerging about the tariffs and its potential impacts (including price #inflation for US buyers and #supply-shock); some numbers are stark:

A few headline numbers from Bloomberg Economics analysis:

- tariffs affect trade worth about $1.3 trillion,

- represent 43% of US imports and

- impacts roughly 5% of US GDP.

- raises the average US tariff rate from near 3% currently to 10.7%, and deal a significant supply shock to the US economy

- Utilizing Federal Reserve Board model parameters (from Trump’s first term) suggest this could reduce GDP by 1.2% and add around 0.7% to core PCE (read – inflation).

- new tariffs on Canada, Mexico and China will cost the average American household $1,245 in purchasing power (per year), trim GDP by 0.2%

Sources for numbers in ADDENDUM:

https://www.bloomberg.com/news/live-blog/2025-02-01/trump-imposes-tariffs?cursorId=679EAB59B2240000

Acknowledgement(s): All customer colleagues we have worked with over the past 15+ years. A special shout-out to the Cambium Networks cross-functional Operations team, and to the insights gained working with cross-functional teams at Samsung Electronics and 2Wire (now CommScope).

Michael Dodd (formerly senior Operations executive at Leapfrog, Juniper among others, and advisor to Zyom)

Disclaimer: No Generative AI was used for composing any of the writeups here (including this one), nor for any data gathering; At this point of time, Generative AI is being used in a “limited editor/ summarizer” role only, not to generate any new content on this site. Readers will be informed in advance if this changes.